1. Business-Friendly Environment

Texas boasts a business-friendly climate that encourages entrepreneurship and growth. Here’s why:

- Low Regulations: Texas keeps regulations minimal, allowing businesses to operate with flexibility and agility.

- Affordable Cost of Living: Lower living costs mean more financial freedom for entrepreneurs.

- Strong Workforce: Texas has a skilled and diverse workforce, making it easier to find talented employees.

2. Asset Protection

When you form an LLC in Texas, you create a legal separation between your personal assets and your business. This means that if your LLC faces financial difficulties or legal issues, your personal assets (such as your home, car, or savings) are generally protected.

3. Tax Benefits

Texas offers several tax advantages for LLCs:

- No State Income Tax: Texas doesn’t impose a state income tax on LLCs or individuals.

- Franchise Tax Exemptions: Small LLCs with annual revenues below a certain threshold are exempt from the state franchise tax.

- Sales Tax Exemptions: Some goods and services are exempt from sales tax, benefiting businesses.

4. Flexible Naming Options

When naming your Texas LLC, you have flexibility:

- Inclusion of “LLC” or “Limited Company”: Texas law requires including “Limited Liability Company” or “Limited Company” in the name. You can abbreviate it as “L.L.C.,” “L.C.,” or “Ltd. Co.”

- Distinguishable Name: Your LLC name must be unique and distinguishable from existing business names in the state.

5. Registered Agent Requirement

Every Texas LLC must have a registered agent. The agent accepts legal documents on behalf of your business. Remember:

- The agent can be an individual Texan or a registered agent service.

- The LLC cannot act as its own registered agent.

- The agent must have a physical address within Texas.

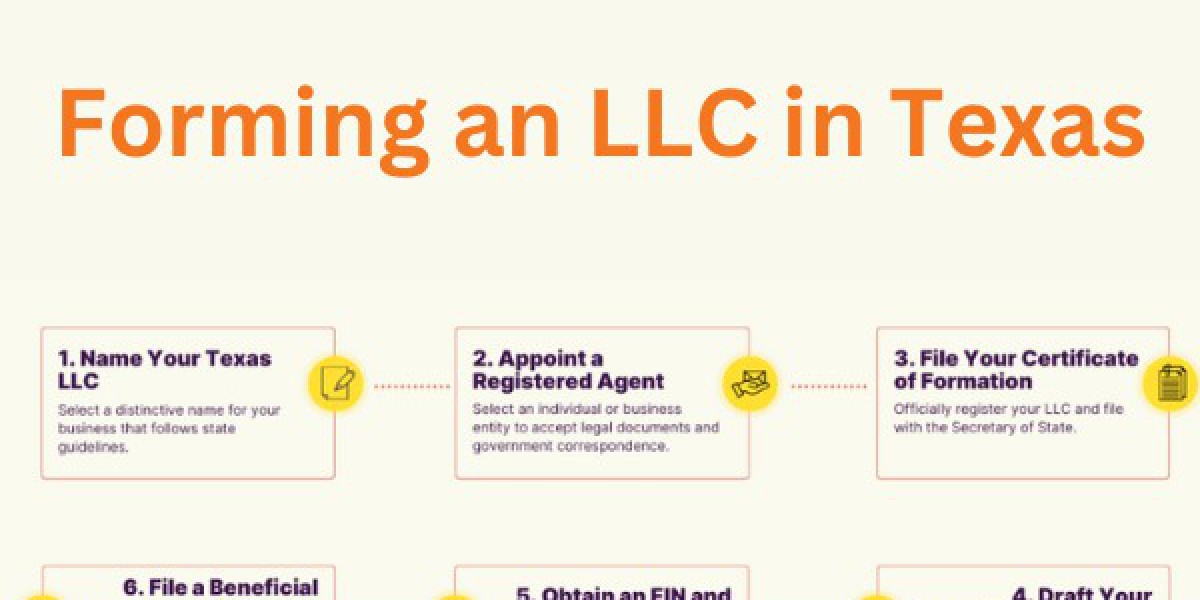

6. Easy LLC Formation Process

Starting an LLC in Texas is straightforward:

- Name Your LLC: Choose a unique name that complies with Texas requirements.

- File Formation Documents: File the Certificate of Formation with the Texas Secretary of State.

- Appoint a Registered Agent: Designate a registered agent for your LLC.

- Create an Operating Agreement: Although not required, having an operating agreement clarifies ownership and management details.

- Obtain an Employer Identification Number (EIN): Apply for an EIN from the IRS for tax purposes.

Conclusion

Texas offers a favorable environment for LLCs, combining business-friendly policies, asset protection, tax benefits, and a straightforward formation process. Whether you’re a small startup or an established business, Texas could be the ultimate destination for your LLC. ?

Remember to consult legal and financial professionals to ensure compliance with all requirements.

I’ve highlighted the key reasons why Texas is an excellent choice for LLC formation. If you need further details or have specific questions, feel free to ask!